GS1 is more than product identification; we’re in a variety of sectors due to their heavy reliance on product and service identification.

A Necessary Benefit

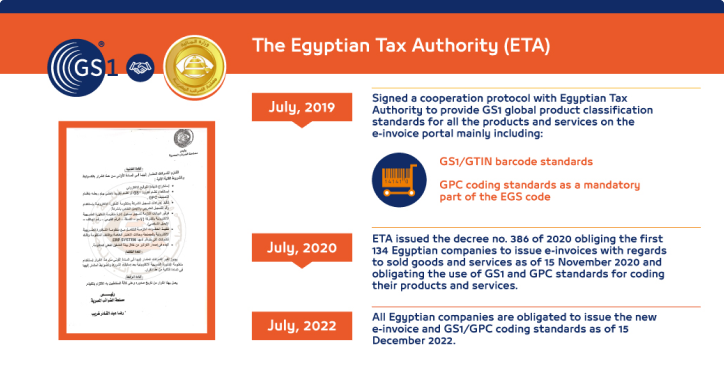

In 2020, GS1 Egypt signed an MOU with the Egyptian Tax Authority. The ETA needed to adopt e-bills instead of having to collect a long paper trail. There needs to be a clear and traceable involvement for every transaction between a taxpayer and the ETA, and e-Invoicing was the way to go.

www.eta.gov.eg/sites/default/files/2022-07/law-323-efatora8.pdf