Get free GPC codes by filling out the form. These codes classify your products and services, ensuring compliance and data accuracy. Once obtained, register them on the e-invoice platform and link them to your product data for Tax Authority reconciliation.

We are honored to serve hundreds of Egyptian companies in all sectors and we seek to include your company on this list

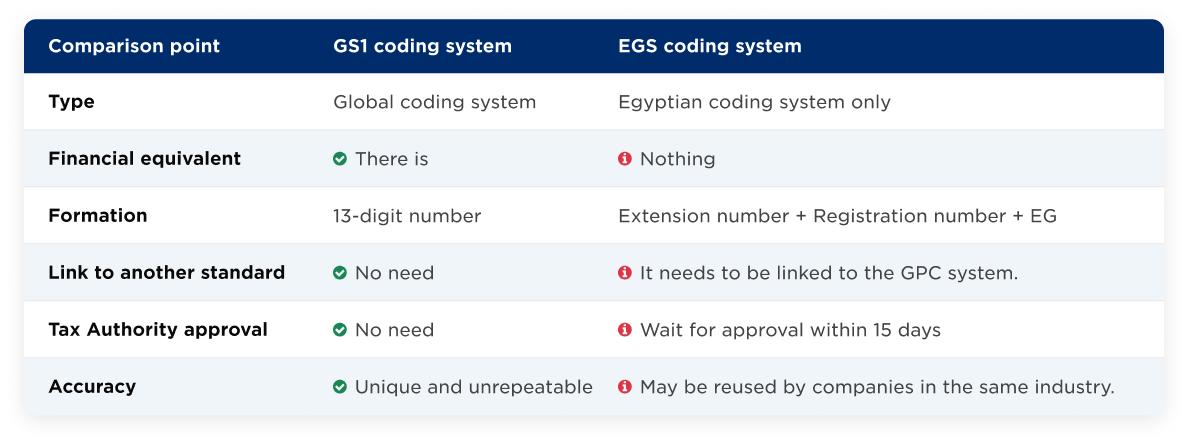

Compare both systems with a simple table to help you make the best choice for your business.

Global coding system

Egyptian coding system only

There is

Nothing

13-digit number

Extension number + Registration number + EG

No need

It needs to be linked to the GPC system.

No need

Wait for approval within 15 days

Unique and unrepeatable

May be reused by companies in the same industry.

After obtaining the GS1 codes that match your goods and services, all you need to do is register the codes on the electronic invoicing platform and link them to the data of each product or service, along with the previously used internal coding numbers, so that they can be aligned with the tax authority.

Daily Transactions

User Companies

Local Members

Member Countries

Commercial Sectors

Enhancing e-commerce efficiency with GS1 standards for seamless product identification and tracking.

Streamlining online retail operations using GS1 barcodes for accurate inventory and smooth logistics.

Improving marketplace reliability with GS1 standards for better inventory management and order fulfillment.

Achieve regulatory, tax, and compliance with GS1 standards

Simplifying business operations with GS1 standards for inventory, invoicing, and supply chain efficiency.

Enhancing digital invoicing and payment solutions using GS1 standards for seamless transactions.

Powering secure and efficient e-payments with GS1-compliant invoicing and financial solutions.

Your company is required to join the system if:

– You are a VAT-registered business in Egypt.

– You issue B2B or B2G invoices.

– You are notified by the ETA to join a specific rollout phase.

Mandatory sectors: large taxpayers, companies dealing with government entities, importers/exporters, industrial firms, and later medium/small enterprises.

If you’re unsure, check if your company is listed in the required phases via the ETA website.

Registration Process:

1. Check Company Readiness:

– Ensure your company is tax registered and your data is correct at ETA.

– Obtain a digital signature (from providers like Egypt Trust or Misr for Central Clearing).

2. Apply for Registration:

– Visit: https://einvoice.eta.gov.eg

– Click on “Register” and fill in the required information.

– ETA will verify your data and grant access credentials.

3. Choose Integration Method:

– Manual entry via the portal (for smaller businesses).

– API Integration with your ERP (for larger businesses).

– Use of middleware or local agent software provided by ETA-approved vendors.

To get all the needed information about the E-Invoice you can check ETA website https://eta.gov.eg or contact the ETA support team on the hotline 16395

GS1 GPC codes are usually available in English, but you can follow this to get Arabic names:

GS1 Egypt team provides localized GPC code tables (English + Arabic) for your products or services you can send excel sheet to [email protected] with the product description and the team will assign the correct GPC and send it back to you.

Great! Here’s a customer-facing question-and-answer format that emphasizes the advantages of using GTINs over EGS product codes in a clear, convincing, and professional way

Using GTINs makes your product registration and invoicing process faster, more organized, and future-proof. Here’s why:

– Instant Validation: GTINs are globally recognized and already structured, so they pass the Egyptian Tax Authority’s validation without the delays of manual EGS code approvals.

– No Need to Classify Manually: Unlike EGS codes, which require selecting and matching categories like family/class/brick, GTINs already contain that information based on international standards.

– Clean and Professional Data: GTINs reduce errors, ensure product consistency, and help you maintain a reliable digital product catalog.

– Efficient Integration: GTINs are compatible with most ERP systems and supply chain platforms, making integration smoother and reducing operational friction.

– Globally Accepted: If you’re exporting or working with multinationals, GTINs are the standard—they speak the same language across borders.

In short: GTINs make e-invoicing easier, more efficient, and aligned with global best practices.