Digital transformation is reshaping Egypt’s business landscape. Integrating digital solutions is no longer optional. It’s a necessity for efficient and accurate operations. Businesses must adapt to thrive.

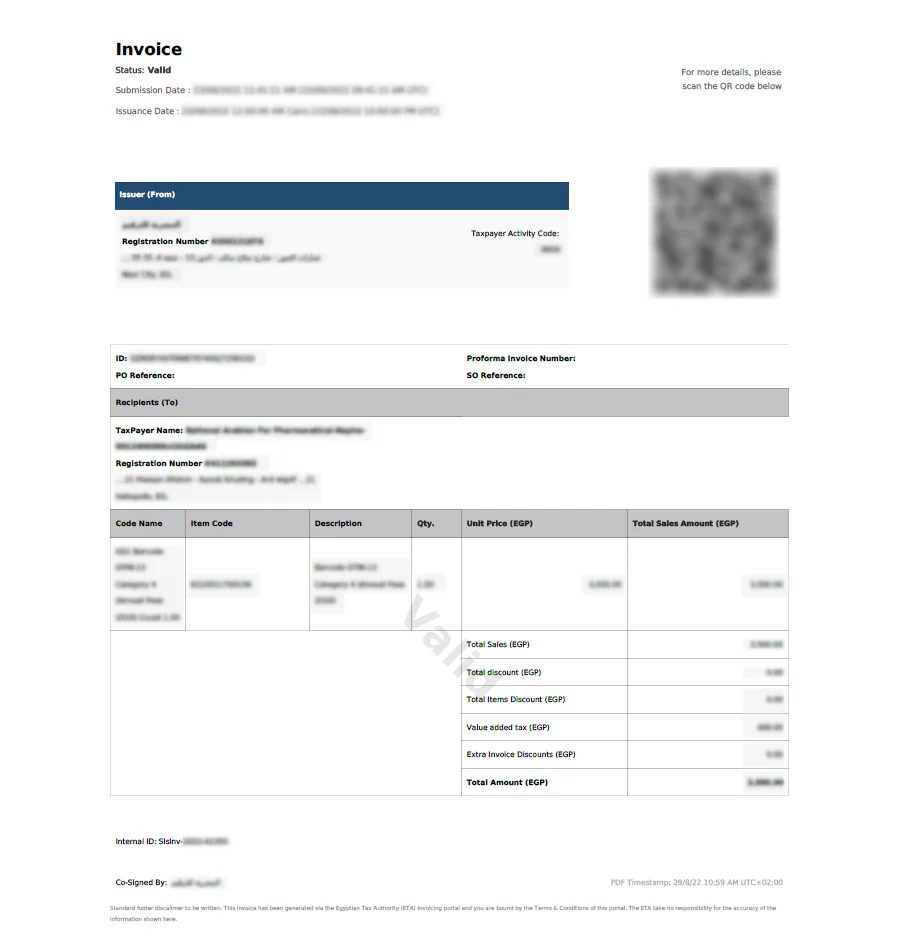

That’s why maintaining digital financial records has become crucial for saving both time and money. One of the most important records is electronic invoices, or e-invoices.

In this article, we’ll answer as many of your questions about Egypt’s new e-invoicing system. What is the e-invoice? How it works, why you need it, and how to use it for efficiency and government compliance.